The Fiduciary Oversight Baseline

(for 401(k) Plan Sponsors)

The Fiduciary Oversight Baseline is a sponsor-focused reference framework intended to help 401(k) plan sponsors understand, evaluate, and document fiduciary oversight processes commonly reviewed under ERISA.

It is designed to support fiduciary awareness and governance clarity by identifying core areas of responsibility and oversight. The Baseline does not constitute a compliance determination, legal opinion, certification, or endorsement, and it does not evaluate investment performance or outcomes.

Fiduciary oversight is not evaluated in isolation. Strength in one area does not offset weakness in another, and gaps often emerge where responsibilities are informally assumed rather than clearly defined, consistently applied, and documented over time.

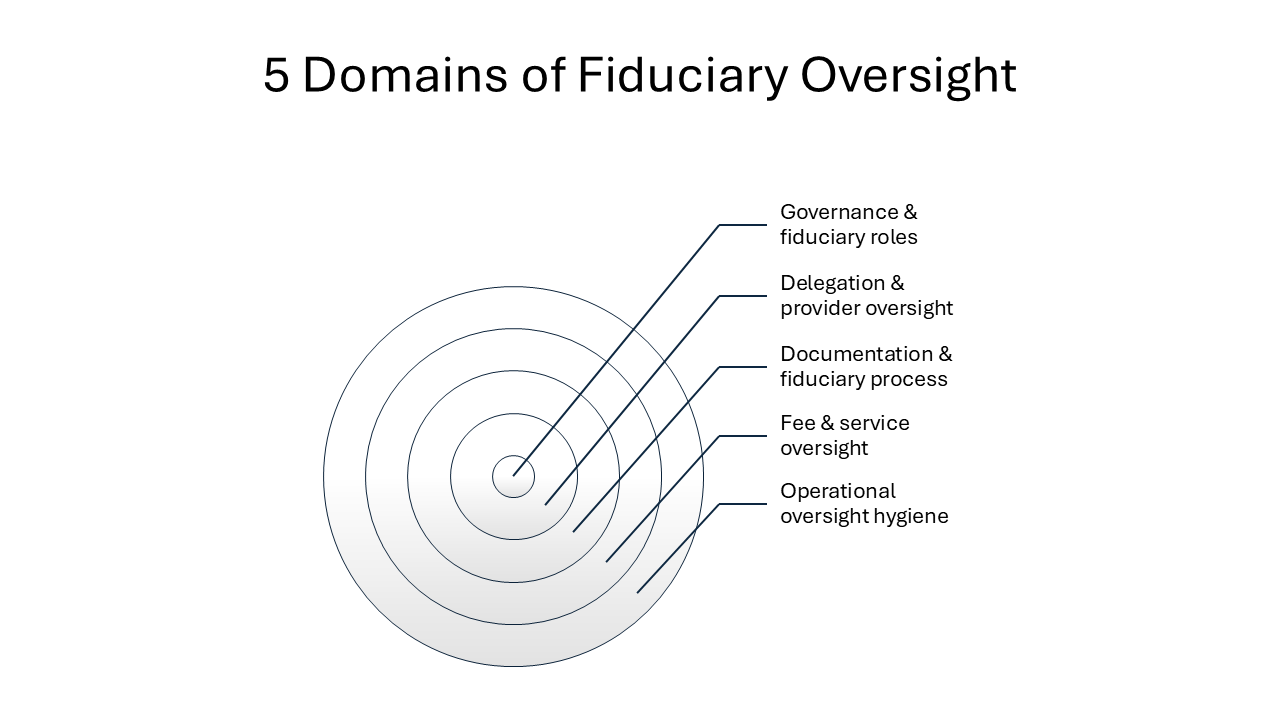

The Five Fiduciary Oversight Domains

The Fiduciary Oversight Baseline organizes sponsor responsibilities into five interrelated domains. These domains are not intended to prescribe specific actions or outcomes, but rather to reflect areas commonly examined when evaluating whether a sponsor has established and maintained a prudent fiduciary governance process.

Governance & Fiduciary Role Definition

How fiduciary responsibility is established, assigned, and understood, including who is responsible for specific decisions and how that responsibility is communicated and maintained.

Delegation & Provider Oversight

Delegation & Provider Oversight

How responsibilities are delegated to service providers, how oversight is exercised, and what fiduciary accountability remains with the sponsor.

Documentation & Fiduciary Process Discipline

How fiduciary decisions are made, recorded, and supported over time, including the consistency and reliability of documentation practices.

Fee & Service Oversight (Process-Focused)

How plan fees and services are evaluated for reasonableness based on the services provided, using a documented and repeatable process rather than outcomes alone.

Operational Oversight Hygiene

Whether day-to-day administrative and operational practices reliably support fiduciary intent, particularly as personnel, vendors, or circumstances change.

Plan sponsors often find that fiduciary responsibilities are clearly understood in some domains and informally assumed in others. These distinctions are not always visible without structured reflection across the full governance framework.

The Fiduciary Self-Assessment is designed to support structured reflection across the five oversight domains, helping sponsors consider how fiduciary responsibilities are currently addressed within their plan governance framework.

Disclaimer

The Fiduciary Oversight Baseline and related self-assessment are educational tools intended to support fiduciary awareness and governance discussions. They do not provide investment advice or recommendations.